-

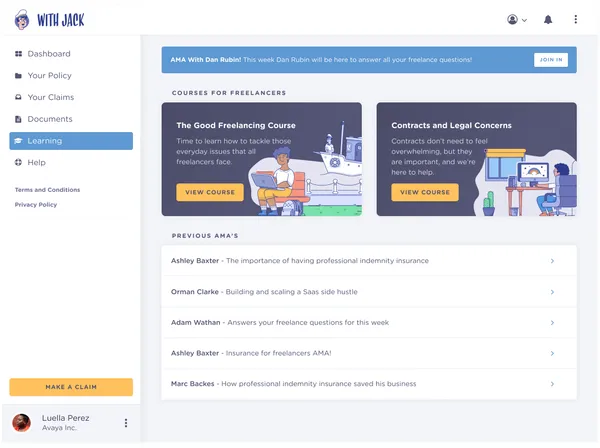

A couple of months ago I soft-launched a piece of software I've been chipping away at for some time. Okay, that's an understatement. A couple of months ago I launched my automated quote and bind system that has been 6.4 years in the making. Let&

-

I want to get back to growing With Jack after a year of distraction by running lots of mini experiments and being more intentional with measuring results. Hold up, aren't we missing a month? I mentioned May's focus would be on SEO. I outsourced a SEO

-

I want to get back to growing With Jack after a year of distraction by running lots of mini experiments and being more intentional with measuring results. This month I focused on creating landing pages for specific industries (photographers, marketers etc) and improving existing ones. Prior to April's

-

I want to get back to growing With Jack after a year of distraction by running lots of mini experiments and being more intentional with measuring results. This month I focused on advertising on different mediums: * paid newsletter * podcasts * social media ads In the past advertising has had poor results.

-

I want to get back to growing With Jack after a year of distraction by running lots of mini experiments and being more intentional with measuring results. The plan was to dedicate February to creating video content, both short-form optimised for Instagram and longer-form for YouTube. I spent a lot

-

I want to get back to growing With Jack after a year of distraction by running lots of mini experiments and being more intentional with measuring results. But January has been weird. The start of the year is usually a time of good intentions, but for me it was the